Data breaches are on the rise, both throughout the U.S. and globally. Anyone and everyone is at risk of falling victim to a data breach or cyber attack, and hackers and cybercriminals come up with new ways to steal sensitive information and personal data every day. As a result, news of identity theft is becoming more and more common. In fact, the federal government recently took steps to rectify fraud and identity theft related to COVID-19 relief.

To keep up with the high rate of identity theft, the field of cybersecurity is rapidly growing. The U.S. Bureau of Labor Statistics projects the information security analyst occupation—those who monitor their organization’s networks for security breaches and investigate when one occurs—to increase substantially in the coming years. However, only time will tell if expanding the profession will have any impact on curbing, or at least slowing, identity theft.

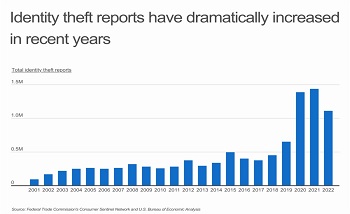

As more and more financial transactions, official registrations, and general interactions have moved online, identity theft reports have increased sharply. From 2001 to 2019, identity theft reports rose steadily from roughly 86,000 to over 650,000. But the onset of the COVID-19 pandemic brought an unprecedented surge in identity theft, likely caused by an increase in e-commerce transactions and a historic expansion to unemployment benefits aimed at mitigating the economic impact from the pandemic. The high number of people applying for government benefits during this time, combined with the rush to distribute these benefits quickly, created vulnerabilities that criminals were able to exploit. As a result, the number of identity theft reports increased over 113% from 2019 to 2020 and remain at elevated levels.

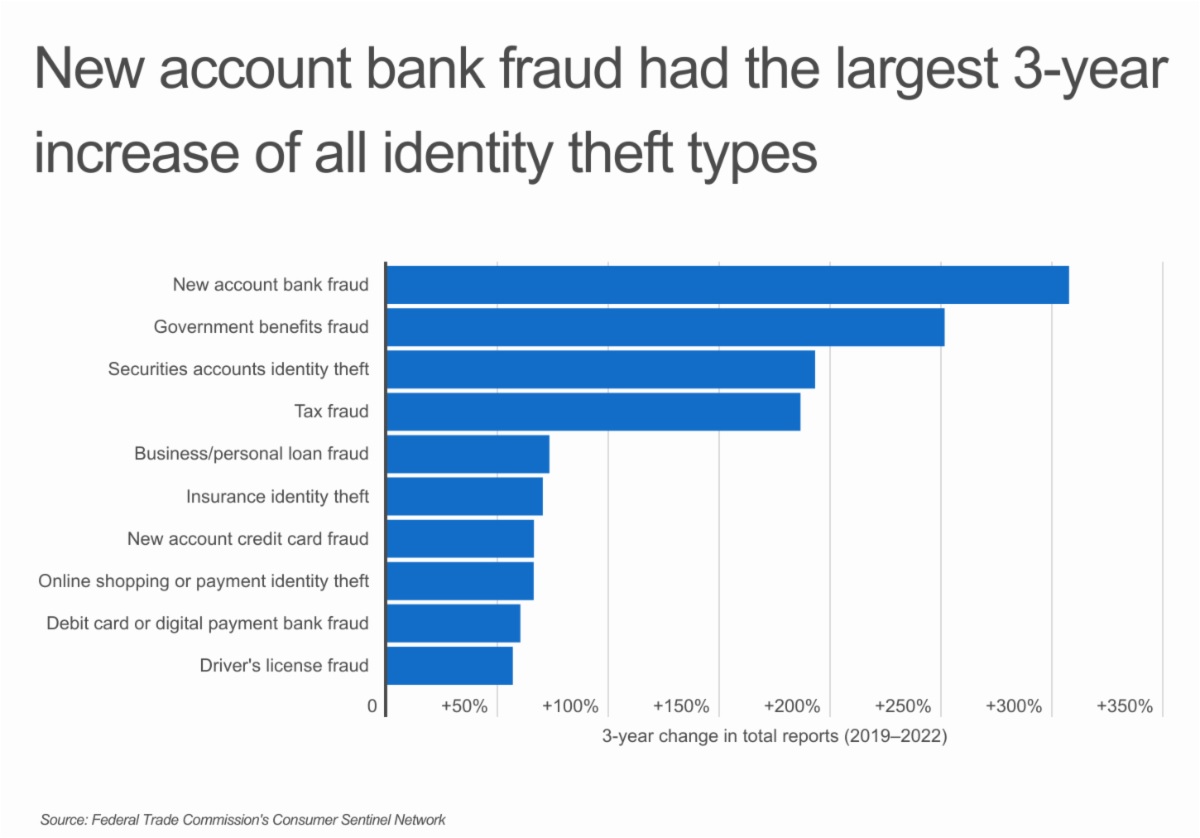

While credit card fraud has long been the most common type of identity theft, in recent years, other types have been rising more quickly. New account bank fraud had the largest three-year increase of all identity theft types, rising approximately 307% between 2019 and 2022. This type of fraud occurs when a scammer has been successfully registered by a financial institution after applying using false personal information for the sole purpose of committing fraud. With the advent of online banking and the ability to open an account without ever leaving one’s home, the opportunity for fraudsters to take advantage of new account fraud is greater than ever before.

Government benefits fraud had the second-largest increase since 2019 at over 250%. Much of this is attributable to the billions stolen from COVID relief assistance programs starting in 2020. The Department of Labor estimated that approximately $46 billion was stolen by criminals via fraudulent pandemic-related unemployment insurance benefits.

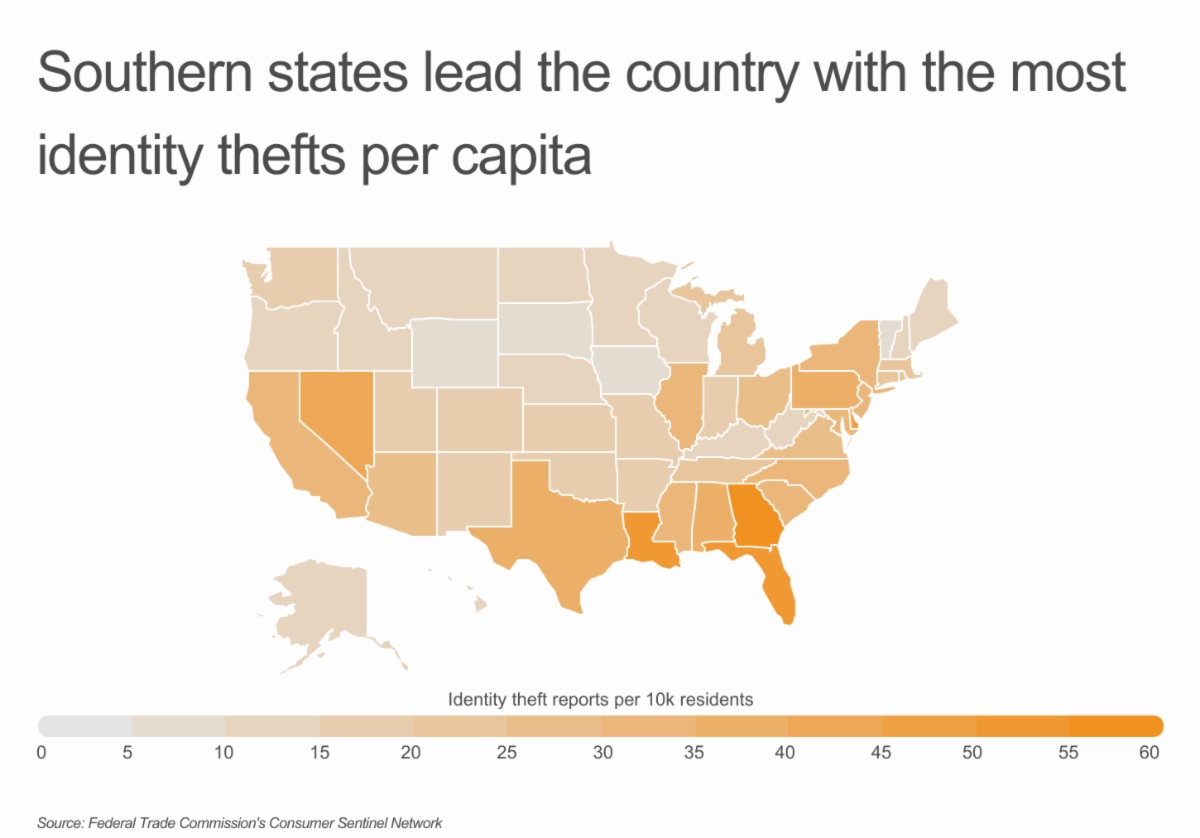

While identity theft occurs throughout the U.S., it’s more prevalent in certain geographic regions. Southern states lead the country with the most identity theft reports per capita, with Georgia topping the list at 55.9 reports per 10,000 residents in 2022. Louisiana and Florida came in second and third with 53.8 and 51.1 reports per 10,000 residents, respectively. The trend applies to small and midsize metros in the South as well: Tuscaloosa, Alabama experienced 106.1 identity theft reports per 10,000 residents, and Baton Rouge, Louisiana had 95.7.

Midwestern states tend to have lower rates of identity theft, with the majority having less than 15 identity theft reports per 10,000 residents. The exceptions are Illinois, Ohio, and Indiana, which had 33.6, 26.3, and 18.3, respectively. South Dakota reported the lowest rate of identity theft, with just 7.5 reports per 10,000 residents last year.

To determine the cities with the highest rates of identity theft, researchers at Upgraded Points analyzed the latest data from the Federal Trade Commission and the U.S. Census Bureau. The researchers ranked locations by the number of identity theft reports per 10,000 residents. In the event of a tie, the location with the larger total number of identity theft reports was ranked higher.

Here is a summary of the data for the Baltimore-Columbia-Towson, MD metro area:

- Identity theft reports per 10k residents: 35.0

- Total number of identity theft reports: 9,926

- 1-year change in identity theft reports (2021–2022): -33.9%

- 3-year change in identity theft reports (2019–2022): +57.1%

For reference, here are the statistics for the entire United States:

- Identity theft reports per 10k residents: 33.4

- Total number of identity theft reports: 1,108,609

- 1-year change in identity theft reports (2021–2022): -22.7%

- 3-year change in identity theft reports (2019–2022): +70.4%

For more information, a detailed methodology, and complete results, you can find the original report on Upgraded Points’s website: https://upgradedpoints.com/finance/cities-with-highest-rates-identity-theft